|  |

The Republic of Armenia is slightly smaller in area than Maryland and has a population of about 3.9 million. Armenia is one of the trans-Caucasus republics formed from the breakup of the Soviet Union; it is bordered by Georgia to the north, Azerbaijan to the east, Turkey to the west, and Iran and Azerbaijan (Nakhichevan) to the south. There are ten administrative regions (called 'marzer') in Armenia, plus the autonomous national capital region; these are shown in Figure 1. The capital city, Yerevan, is located in the west central part of the country and has a population of about 1.25 million. Armenia's currency, the dram, has an exchange rate (as of December 2002) was about 588 dram per U.S. dollar. The gross domestic product (GDP) in 2001 was estimated to be $11.2 billion (purchasing power parity).

The largely Armenian enclave of Nagorno-Karabakh inside neighboring Azerbaijan was the subject of hostilities between Armenia and Azerbaijan in the early 1990s; a cease fire has been in effect since then, but there has not yet been a formal resolution. Azerbaijan has a trade blockade against Armenia which Turkey has also mostly followed. This conflict has affected the routing of oil pipelines and other energy-related matters.

Armenia's energy policy, which was published in November 1996, emphasizes production targets and investment needs, and also includes plans for moving toward a free market. The priorities are:

The plan for privatization is to first restructure and incorporate interconnected energy complexes, and then privatize them with strategic investors. Non-strategic facilities will be privatized by direct transfer to the private sector. New energy complexes will be built by private investors under Build-Own-Transfer (BOT) and Build-Own-Operate-Transfer (BOOT) schemes.

Armenia's Energy Law was enacted in 1997 after an energy crisis in the mid 1990s, and in 2001 the law was revised by the national assembly. On April 11, 2001, the revised Energy Law of the Republic of Armenia went into effect. The law set up the Energy Regulatory Commission, which has control over licensing, and laid out a licensing procedure for firms in natural gas, electricity, and combined heat and power (i.e., cogeneration), which will require them to submit plans for safety and environmental protection to the Commission. Licensees must also submit to the Commission their calculations of energy losses associated with their operations. The Commission approves all contracts between energy firms and users.

Armenia is almost completely dependent on imported energy. There are no oil wells, gas wells, or refineries in Armenia, and there is also no coal production. To diversify its fuel supplies, Armenia has attempted to implement pipeline projects that would obtain natural gas from Iran. The only domestically produced primary energy is electricity from the hydroelectric plants and the single nuclear power plant.

An historical summary of Armenia's Total Primary Energy Production (TPEP) and Consumption (TPEC) is shown in Table 1.

| 1992 | 1993 | 1994 | 1995 | 1996 | 1997 | 1998 | 1999 | 2000 | |

| TPEP | 0.03 | 0.04 | 0.04 | 0.02 | 0.04 | 0.03 | 0.03 | 0.04 | 0.04 |

| TPEC | 0.21 | 0.15 | 0.11 | 0.09 | 0.11 | 0.09 | 0.09 | 0.10 | 0.10 |

Oil

Armenia possesses no oil reserves, no oil

production, and no refineries. There are no oil pipelines into Armenia, and

refined products arrive through rail or truck shipments. In the mid 1990s there

was some oil exploration by Greek and U.S. companies, but this activity ended in

1999 without success.

An historical summary of petroleum production and consumption in Armenia is shown in Table 2.

| 1992 | 1993 | 1994 | 1995 | 1996 | 1997 | 1998 | 1999 | 2000 | |

| Production (total)* | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Production (Crude Oil only) | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Consumption | 48 | 25 | 8 | 6 | 3 | 3 | 3 | 4 | 4 |

Oil products consumed in Armenia are all imports, primarily from the Batumi refinery in neighboring Georgia. In 1999, Armenia's imports of oils products from neighboring countries were as follows:

| Refined Product | 1992 | 1993 | 1994 | 1995 | 1996 | 1997 | 1998 | 1999 |

| Motor Gasoline | 14 | 9 | 1 | 1 | 0 | 0 | 1 | 1 |

| Jet Fuel | 3 | 1 | 1 | 1 | 0 | 0 | 0 | 0 |

| Kerosene | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Distillate Fuel Oil | 4 | 2 | 2 | 1 | 1 | 1 | 1 | 1 |

| Residual Fuel Oil | 25 | 11 | 3 | 2 | 1 | 1 | 1 | 2 |

| Liquefied Petroleum Gases | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Lubricants | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Other * | 1 | 1 | 1 | 1 | 0 | 0 | 0 | 0 |

| Total | 48 | 25 | 8 | 6 | 3 | 3 | 3 | 4 |

Natural Gas

Armenia has no natural gas reserves and

produces no natural gas. All the natural gas used in Armenia presently comes

from Russia, via Georgia. At its peak in 1989, gas consumption was about

6.5 billion cubic meters (i.e., about 200 billion cubic feet) per

year. However, annual gas consumption has stayed below 2 billion cubic

meters since 1992.

An historical summary of natural gas production and consumption in Armenia is shown in Table 4.

| 1992 | 1993 | 1994 | 1995 | 1996 | 1997 | 1998 | 1999 | 2000 | |

| Production | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 |

| Consumption | 0.066 | 0.049 | 0.057 | 0.057 | 0.064 | 0.046 | 0.049 | 0.046 | 0.050 |

Armrosgazprom, the gas transmission and distribution utility in Armenia, is a closed joint-stock company which is 45% owned by Russia's Gazprom and 10% owned by the Russian company Itera. The remaining 45% is owned by the Armenian Government. This ownership structure has been in effect since July 2001, when Itera acquired its share in exchange for writing off Armenia's debt for past gas deliveries. Prior to July 2001, gas transmission and distribution was handled by the state-owned company Armgazprom, which passed from existence when Armrosgazprom was formed.

Since then, Armenia has continued to have problems keeping current in its payments for gas deliveries, which prompted Itera to reduce the amount of gas supplied to Armenia in the latter part of 2001 as a response to the tardy payments. One of the causes of these payment problems has been the difficulty in accurately determining how much gas was being consumed by individual users, so Itera is now trying to meter all customers.

Itera has also tried to promote the use of natural gas vehicles in Armenia; there are seven natural gas filling stations in Armenia with a total capacity of 2,250 fillings per day. Itera has plans for six more.

Coal

Reserves and

Exploration

Armenia has coal reserves estimated at 200 to

250 million tons. There are six known coal fields, at Antaramut (in the

north), Ijevan (northeast), Jajur (northwest), Jermanis (west central), Nor

Arevik (south), and Shamut (north). In addition, there are also oil shale

deposits at Jajur, Nor Arevik, Aramus (central), and Dilijan (north central).

However, there has never been much of a systematic evaluation to determine how

much coal or oil shale can be mined economically. There are exploitable deposits

at Ijevan, in the northeast part of the country, and Jermanis, in the west

central part of the country, and there are plans to open at least one

state-owned mine. A map of Armenia's coal and oil shale deposits is shown in

Figure 2.

Production and Consumption

Currently,

there is no coal production in Armenia. Armenia's coal consumption of about

3,000 tons per year of imported hard coal is mainly for home heating. An

historical summary of coal production and consumption in Armenia is shown in

Table 5.

| 1992 | 1993 | 1994 | 1995 | 1996 | 1997 | 1998 | 1999 | 2000 | |

| Production Anthracite Bituminous Lignite |

n/a n/a n/a n/a |

n/a n/a n/a n/a |

n/a n/a n/a n/a |

n/a n/a n/a n/a |

n/a n/a n/a n/a |

n/a n/a n/a n/a |

n/a n/a n/a n/a |

n/a n/a n/a n/a |

n/a n/a n/a n/a |

| Consumption | 0.16 | 0.00 | 0.04 | 0.00 | 0.01 | 0.01 | 0.01 | 0.00 | 0.00 |

Nuclear Power

Armenia has one nuclear power

plant, at Medzamor (sometimes known as Metsamor) in Armavir marz about 28

kilometers west of Yerevan and 16 kilometers from the Turkish border. The

facility had a nominal generating capacity of 800 megawatts (MWe) and a

design life of 30 years. There are two Soviet-design VVER-440 reactors at the

power plant -- the first reactor was brought online at the end of 1975 and is of

a first generation design (V-230), while the second reactor, of a somewhat newer

and safer design (V-270, which has core reinforcements and additional water

pumps), was put into operation at the beginning of 1980.

The plant was totally shut down for about six years following the December 1988 Armenian earthquake, although the facility sustained no damage. A very severe energy shortage in the mid 1990s (some homes received electricity only two hours per day) caused the Armenian government to decide to restart the second unit, which, after some safety improvements, came back online at the end of October 1995 and now provides almost one-third of Armenia's electric power. The first unit has not been and will not be restarted.

Since the restart, however, the power plant has experienced ongoing financial problems. In July 2001, the one operating reactor was shut down for planned maintenance, but there was a delay in restarting it because of financial problems -- Russia was owed $17 million for past deliveries of nuclear fuel and set the price of new fuel at another $14 million. It was not until November 2001 that plant began generating electricity again.

Armenian and Russian officials believe that the reactor could be operated until 2016, since there had been a 6-year inactive period. However, the EU has been pressuring Armenia to shut the plant down because of its inherently unsafe design that cannot meet EU nuclear safety standards, as well as the region's continual risk of earthquakes. In the meantime, additional safety improvements are being installed at the plant with technical and financial assistance of the U.S. and the EU. The U.S. Department of Energy has allocated $18 million for the effort and the EU provided $11 million. France recently commissioned a $40 million storage facility for Armenian nuclear waste. Britain has put up 80 million pounds sterling for additional safety measures at the plant.

It has been estimated that if all safety upgrades that are needed were implemented at Medzamor, they would cost upwards of $1 billion. The Armenian government's current plan had been to retire the plant by 2004 and avoid the cost of the upgrade, if other generating facilities are available. The EU is pledging 100 million euros to help Armenia build other generating facilities to replace Medzamor, but a much larger amount, perhaps as much as $1 billion in foreign investment, would be necessary to build sufficient generating capacity. Because of this, Armenia's Deputy Energy Minister announced in March 2002 that the power plant will operate until the year 2008.

Hydroelectric and Other Renewable

Energy

Hydroelectric

Power

Armenia's largest and longest river is the Araks (sometimes

known as the Aras, the Araz, or the Arax), which flows southeastward from Turkey

and forms part of Armenia's border with Turkey and Iran before entering

Azerbaijan and merging into the Kura River which eventually empties into the

Caspian Sea. The most important river in Armenia, however, is the Hrazdan, which

outlets from Lake Sevan and flows southwestward, through Yerevan, to merge with

the Araks. A map of Armenia's rivers is shown in Figure 3.

Lake Sevan is an alpine lake (elevation 1,900 meters above sea level), and is one of the largest high-elevation lakes in the world. Many small rivers flow into the lake, but the only outlet is the Hrazdan. In the 1930s, a project was implemented to divert most of Lake Sevan's water into the Hrazdan for irrigation and to generate hydroelectric power. By the 1950s, a hydroelectric cascade had been constructed, but nearly one-third of the lake waters had been drained. In the 1960s, remedial action was undertaken, and a tunnel was constructed to divert water from the Arpa River (a tributary of the Araks) into the lake; the project was completed in 1980 and the lake's level stabilized. Another tunnel is presently under construction that will feed additional water into Lake Sevan from the Vorotan River. A third tunnel, from the Debet River into the Lake, is being planned though construction seems doubtful at this point.

Armenia's hydroelectric power plants supply about 30% of the country's electricity. Almost all of the hydropower is generated from the Hrazdan and Vorotan Rivers. There are six hydroelectric plants on the Hradzan River in west-central Armenia, including the Sevan plant which also acts as a water intake structure for the Hrazdan from Lake Sevan. These six power plants are known as the Sevan-Hrazdan Cascade and have a combined nominal generating capacity of more than 500 MWe. However, these hydroelectric plants suffer from aging equipment and deferred maintenance, and they generally have much less capacity than their nameplate ratings. Another problem with hydroelectric generation from the Sevan-Hrazdan Cascade is that irrigation needs reduce the amount of water available from the lake for hydroelectric power production. As a result, the hydroelectric power plants must generally be operated as run-of-the-river, which means they can only produce electricity at much less than their nameplate capacity.

Armenia is trying to regain some of the lost capacity by various major refurbishment projects. One of them, at the Kanaker power plant, will include work on turbines and generators with their associated auxiliaries, as well as gates and penstocks and also control and substation equipment. The international consulting team on the project includes the British engineering firm Knight Piesold. The Kanaker power plant had been derated from its nominal 102 MWe capacity down to just 38 MWe. A similar situation exists at Gyumesh, the largest hydroelectric power plant in the country, where the capacity had to be derated from 224 MWe down to 65 MWe. There was damage to its spillway in 1995, which was repaired in 10 months after which operation resumed. However, other refurbishment is also needed.

There is another, newer cascade of three hydroelectric power plants on the Vorotan River in Syunik marz in southern Armenia, which have a combined capacity of about 400 MWe and an annual electricity production of more than 1 billion kilowatt-hours (kwh), though completion of the Vorotan tunnel will result in a significantly reduction; the Vorotan Cascade power plants have the lowest cost of production per kilowatt-hour in Armenia.

A summary of Armenia's largest capacity hydroelectric power plants is shown in Table 6.

| Generating Facility | Location | Rated Capacity (MWe) | |

| River | Marz | ||

| Gyumesh (Arghel) | Hrazdan | Kotayk | 224 |

| Shamb | Vorotan | Syunik | 170 |

| Tatev | Vorotan | Syunik | 156 |

| Kanaker | Hrazdan | Yerevan | 102 |

| Atarbekyan | Hrazdan | Kotayk | 82 |

| Spandaryan | Vorotan | Syunik | 76 |

| Arzni | Hrazdan | Kotayk | 71 |

| Yerevan | Hrazdan | Yerevan | 49 |

| Sevan | Hrazdan | Gegharkunik | 34 |

| Dzora | Debet | Lori | 26 |

A new hydroelectric plant construction program has been proposed by the Armenian government that would build at least four large (i.e., at least 20 MWe) hydroelectric plants and more than 30 smaller ones for a combined capacity of about 300 MWe. The largest of these planned hydroelectric power plants are described in Table 7. The cumulative cost could be at least $500 million; it is not yet definite that any of these proposed projects will funded.

| Generating Facility | Location | Rated Capacity (MWe) |

Status | |

| River | Marz | |||

| Megri | Araks | Syunik | 79 | Planned |

| Shnokh | Debet | Lori | 75 | Planned |

| Lori-Berd | Miskhan, Dzoraget | Lori | 60 | Planned |

| Akhuryan Reservoir | Akhuryan | Shirak | 20 | Planned |

The planned Megri hydroelectric facility would be a joint project with Iran that would alone cost $60-80 million and take perhaps five years to build. Azerbaijan has objected to the project, claiming that it will reduce water supplies to its Nakhichevan enclave. The largest hydroelectric facility being fully financed and constructed by a private power developer is the 5 MWe Jradzor power plant being constructed by the American firm ESI in Shirak marz. When completed, ESI will be the owner and operator. This would be one of a series of small hydroelectric power plants that ESI would like to build in Armenia.

Other Renewable Energy

Armenia has only a

limited amount of renewable energy resources, none of which is yet developed to

any extent at all. According to studies done in the late 1990s, there is no

commercially viable geothermal resource, but there is a wind energy resource of

as much as about 180 MWe that might someday be exploited.

Energy Transmission Infrastructure

Electricity Transmission and Distribution

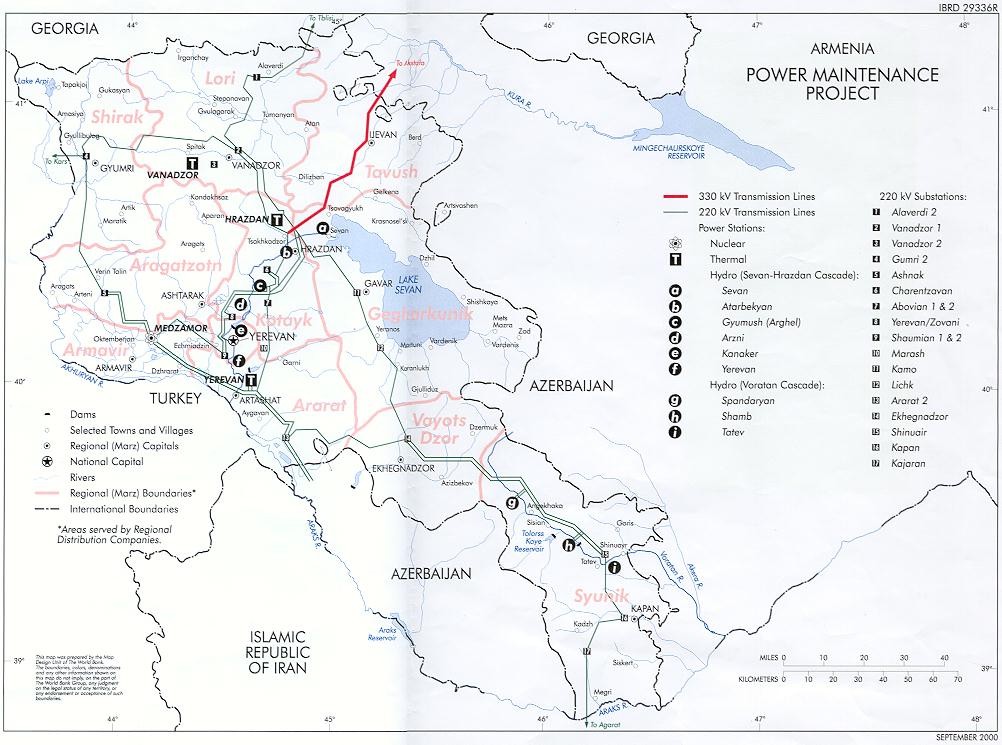

The

electric transmission system of Armenia is operated by the state-owned firm

ArmEnergo, and consists of 164 kilometers of 330 kilovolt (kV) lines, 1,320

kilometers of 220 kV lines, and 3,146 kilometers of 110 kV lines. A

map of Armenia's electric transmission grid is shown in Figure 4.

Armenia is part of the Trans-Caucasian Power Pool. However, Armenia's equipment designated for the power pool is no longer functioning due to the trade blockages by Azerbaijan and Turkey. There are also several transmission lines to neighboring areas that are not currently being used because of political conflicts. These include:

Besides these, there is a 220 kilovolt line connecting Armenia to Georgia that was reactivated in 1997 and also a 220 kV line built to Iran that has been used occasionally. In July 2002, Armenia and Iran signed an agreement to cooperate on electric power transmission, including construction of the Syunik-Center high-voltage power line. The Iranian company Sanir will invest $10 million for the construction, while as its part of the deal, Armenia will supply $10 million worth of electricity to Iran. Construction of the Armenian section of the line between Agarak and Shinuair could be completed before the end of 2003. Armenia currently trades power back and forth with Iran over existing power links -- in summer Armenia exports electricity to Iran while in the winter it imports from Iran. Armenia also supplies some electricity to Georgia.

Oil Pipelines

Armenia is not currently

served by any pipelines carrying crude oil or oil products. All oil products are

imported via trucks or railroads.

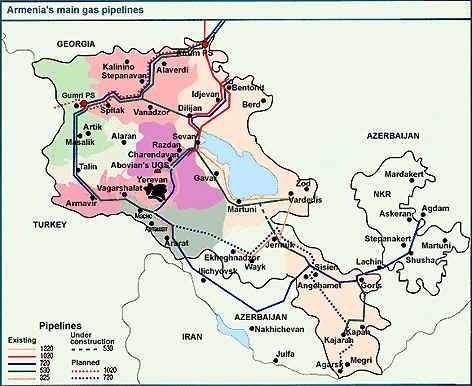

Natural Gas Pipelines and Storage

Armenia

has a substantial natural gas infrastructure dating from the Soviet era, even

though much of it is not currently being used because of the trade blockade from

Azerbaijan. Presently, all of Armenia's natural gas comes from the north, from

Russia, mainly via the Kazakh-Berd-Sevan pipeline through Georgia. This and

other pipelines could become important if the blockade ended and they became

part of a broader network of pipelines network that could supply gas to Turkey.

There is also a pipeline into Armenia from Azerbaijan; however, it has been

inactive since the beginning of the conflict over Nagorno-Karabakh. It is

expected that if there were a settlement Azerbaijan could again become a major

natural gas supplier using this pipeline.

There is considerable interest in a proposed gas pipeline from Iran into Armenia which would act to diversify Armenia's gas supply; This proposed Iran-Armenia pipeline would include a 41-kilometer section in Armenia and another 100 kilometers of pipeline in Iran; the total cost could be more than $100 million. The Greek company Asprofos was allocated funds equivalent to $150,000 by the Greek government to complete a feasibility study. The overall cost of the pipeline would be about $120 million, and the capacity would be about 1 billion cubic meters per year. Addition of a compressor station, at extra cost, would raise the capacity up to about 3 billion cubic meters per year. As of January 2002, Russian and French companies had been invitied to participate in the financing and construction of the pipeline.

Armenia presently has about 240 million cubic meters of underground natural gas storage capacity that can be used for seasonal adjustment of natural gas flows. The largest reservoir is the Abovian gas depot, in Kotayk marz not far from Yerevan, which during the Soviet era could store up to about 180 million cubic meters of natural gas; now, however, the facility can hold no more than about 80 million cubic meters without leaking. Refurbishment of this facility is of great strategic importance from a gas supply management consideration; about $20 million will be needed for the rehabilitation. The Abovian underground gas storage facility could also be useful in transiting gas from central Asia through Armenia to Turkey.

There are about 2,000 kilometers of main natural gas pipelines and 11,000 kilometers of gas distribution pipelines in Armenia. The total capacity of Armenia's gas transportation system is presently about 10 billion cubic meters per year. According to Itera's assessment, only 20 to 25% of the Armenian natural gas transportation system serving the home market is now being utilized. Itera is seeking to increase utilization by marketing gas for export (i.e., transit through Armenia) and use in electric power production. A map of Armenia's natural gas transmission pipeline system is shown in Figure 5.

Electricity

Generation

and Consumption

Electricity generation in Armenia had dramatically

decreased over the past decade. In 1989-90, about 15 billion kwh was

annually generated; by 2000, the amount of electricity generation had been

reduced by almost two-thirds. Electricity consumption has also decreased since

the late 1980s, but part of the reason is that consumers were forced to do

without. During the mid 1990s, a severe electricity shortage resulted in

extended blackouts for many of the country's electricity consumers. Armenia's

need for electricity is expected to rise during the next decade, as the country

continues to modernize. An historical summary of electricity generation and

consumption in Armenia is shown in Table 8.

| 1992 | 1993 | 1994 | 1995 | 1996 | 1997 | 1998 | 1999 | 2000 | |

| Net Generation hydroelectric nuclear geo/solar/wind/biomass conventional thermal |

8.6 3.0 0.0 n/a 5.6 |

6.1 4.2 0.0 n/a 1.9 |

5.5 3.5 0.0 n/a 2.0 |

5.0 1.9 0.0 n/a 3.1 |

5.8 1.6 2.1 n/a 2.2 |

5.7 1.4 1.4 n/a 2.9 |

5.8 1.5 1.4 n/a 2.9 |

6.3 1.9 2.1 n/a 2.3 |

5.7 1.8 1.8 n/a 2.1 |

| Net Consumption | 8.3 | 5.7 | 5.1 | 4.7 | 5.4 | 5.3 | 5.4 | 5.6 | 4.9 |

| Imports | 0.3 | 0.1 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.5 | 0.3 |

| Exports | 0.1 | 0.1 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.7 | 0.7 |

Installed Capacity

There has been a

relatively flat trend in Armenia's electricity generating capacity -- there have

been few capacity additions or retirements over the past decade, indicative of

the neglect the electricity generating sector has received. Nearly 40% of the

equipment in use at the power plants in Armenia has been in use for more than 30

years. About 70% of the equipment in use at the country's hydroelectric power

plants has been in use for more than 35 years, and about 50% for nearly 50

years.

An historical summary of installed electricity generating capacity in Armenia is shown in Table 9.

| 1992 | 1993 | 1994 | 1995 | 1996 | 1997 | 1998 | 1999 | 2000 | |

| Hydroelectric | 1.02 | 1.02 | 1.02 | 1.01 | 1.01 | 1.01 | 1.01 | 1.01 | 1.01 |

| Nuclear | 0.00 | 0.00 | 0.00 | 0.00 | 0.38 | 0.38 | 0.38 | 0.38 | 0.38 |

| Geothermal/Solar/ Wind/Biomass |

n/a | n/a | n/a | n/a | n/a | n/a | n/a | n/a | n/a |

| Conventional Thermal | 1.79 | 1.79 | 1.76 | 1.76 | 1.76 | 1.37 | 1.37 | 1.35 | 1.35 |

| Total Capacity | 2.81 | 2.81 | 2.78 | 2.77 | 3.14 | 2.76 | 2.75 | 2.74 | 2.74 |

Industry Overview

At present there are

only three thermal-electric power plants in Armenia, all of which have exceeded

their planned operating life spans and are in need of refurbishment. The largest

of these is the 1,100 MWe oil-fueled Hrazdan power plant in Kotayk marz.

The 96 MWe Vanadzor power plant, in southern Lori marz, had a long inactive

period before it was privatized by being sold to Zakneftgasstroy-Promethey; it

is now producing power again.

A summary of Armenia's thermal-electric power plants is shown in Table 10.

| Generating Facility | Location (marz) |

Technology | Fuel | Capacity (MWe) |

| Hrazdan | Kotayk | Conventional Thermal | Oil | 1,100 |

| Yerevan | Ararat | Conventional Thermal | Natural Gas | 550 |

| Vanadzor | Lori | Conventional Thermal | Natural Gas | 96 |

Only one major thermal-electric power plant is being planned for now, a 165 MWe natural gas-fueled gas turbine combined cycle facility that would be a new power block addition to the existing Yerevan power plant. The expected cost would be about $200 million.

Air Pollution

The Armenian Energy Law of

2001 requires energy firms to submit environmental and safety plans to the

Armenian Energy Regulatory Commission. However, it is not clear how much

attention will be devoted to the environment in Armenia because of the pressing

economic problems.

There have been measurements of ambient air pollution concentrations of nitrogen oxides (NOx), carbon monoxide (CO), and suspended particulate in Armenia's four largest cities -- Yerevan, Vanadzor, Hrazdan, and Alaverdi. All four cities were found to exceed limits for particulate emissions, with the worst situation in Yerevan. Historical anthropogenic SO2, NOx, CO, and non-methane volatile organic compounds (NMVOCs) emissions in Armenia are shown in Table 11.

| Component | 1990 | 1991 | 1992 | 1993 | 1994 | 1995 | 1996 | 1997 | 1998 | 1999 |

| SO2 | 72 | 60 | 44 | 6 | 4 | 3 | 2 | 0 | 3 | 1 |

| NOx | 46 | 40 | 22 | 12 | 12 | 15 | 11 | 15 | 11 | 11 |

| CO | 304 | 377 | 195 | 145 | 128 | 174 | 126 | 224 | 124 | 124 |

| NMVOCs | 81 | 70 | 31 | 20 | 17 | 23 | 18 | 35 | 17 | 17 |

Greenhouse Gas Emissions

Armenia's carbon

dioxide (CO2) emissions over the past decade have been on the

decline, mostly because of the country's economic problems. The largest decrease

was in CO2 emissions from petroleum usage. An historical summary

of CO2 emissions from fossil fuel use in Armenia is shown in

Table 12.

| Component | 1992 | 1993 | 1994 | 1995 | 1996 | 1997 | 1998 | 1999 | 2000 |

| CO2 from coal | 0.10 | 0.00 | 0.02 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| CO2 from natural gas | 0.99 | 0.75 | 0.85 | 0.85 | 0.96 | 0.69 | 0.75 | 0.69 | 0.75 |

| CO2 from petroleum | 2.13 | 1.06 | 0.34 | 0.24 | 0.13 | 0.13 | 0.15 | 0.20 | 0.18 |

| Total CO2 from all fossil fuels |

3.22 | 1.81 | 1.22 | 1.10 | 1.10 | 0.83 | 0.89 | 0.89 | 0.93 |

Privatization programs in Armenia's energy sector have made some progress. In 1998, Armenia passed a law which could eventually privatize electric generation and distribution, while keeping transmission and the nuclear plant under state control. On February 21, 2002, the government of Armenia issued a decree reorganizing four state-owned regional electric distribution companies, Yerevan Electric Network, Northern Electric Network, Southern Electric Network, and Central Electric Network, into one joint stock company, Armenian Electric Networks CJSC. In August 2002, this newly-formed Armenian Electric Networks was privatized by sale of 80% of its stock to the only bidder, Midland Resources Holding (registered in Britain's tax-free Channel Islands), for $37 million. Originally, it had been hoped that such a sale would bring in as much as $250 million. The government of Armenia expects that Midland will invest $100 million in modernizing electric distribution in the next 7 or 8 years.

Other energy sector privatizations in the past few years included the sale of the Vanadzor power plant to Zakneftgasstroy-Promethey. Thirteen small hydroelectric plants have also been privatized.

Armenia has experienced a slow economic recovery since the 1988 earthquake. After independence and the 1991-94 war with Azerbaijan, Armenia has tried to move toward a free market economy. However, Armenia suffered spillover effects from Russia's 1998 downturn, since Russia remains the main trading partner. Armenia had good economic growth for the past several years, but unemployment remains high. It is estimated that the GDP growth in 2002 will be 5.4%.

An historical summary of Armenia's macroeconomic indicators is shown in Table 13.

| Component | 1995 | 1996 | 1997 | 1998 | 1999 | 2000 |

| GDP* (billion drams) | 522.3 | 661.2 | 804.3 | 955.4 | 987.4 | 1,033.3 |

| Annual GDP Growth Rate** (percent) |

7.0 | 5.8 | 3.3 | 7.3 | 3.3 | 6.0 |

| End-of-Year Inflation*** (percent) |

n/a | 18.8 | 13.8 | 8.7 | 0.6 | -0.8 |

| Year-End Exchange Rate (dram/US$) |

n/a | 413 | 491 | 505 | 535 | 540 |

Armenia's exports in 2001 were estimated to be $338.5 million. The main exports were cut diamonds, scrap metal, machinery and equipment, brandy, and copper ore. Armenia exports mostly to Belgium, Iran, Russia, Turkmenistan, and Georgia.

Armenia's imports in 2001 were $868.6 million. The main imports were natural gas, petroleum products, tobacco products, foodstuffs, and uncut diamonds. The imports are predominantly from Russia, the United States, Belgium, Britain, and Turkey.

| For more information, please contact our Country Overview Project Manager: |

Richard

Lynch U.S. Department of Energy Office of Fossil Energy 1000 Independence Avenue Washington, D.C. 20585 USA telephone: 1-202-586-7316 |

|

Return to Armenia page

|

| last updated on December 10, 2002 | Comments On Our Web Site Are Appreciated! |