|

|

|

|

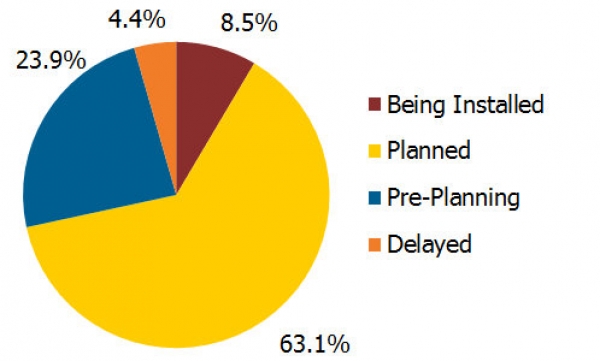

| NPD Solarbuzz: Completion Status for 43 GW US Solar PV Project Pipeline. |

Michael Barker, senior analyst at NPD Solarbuzz said: “The increase in new solar PV projects being planned or under construction is driving double-digit annual growth forecasts for PV adoption within the United States. Large-scale PV projects exceeding 20MW continue to dominate the pipeline in terms of installed capacity, stimulated by state-based renewable portfolio mandates. Projects of all sizes have become increasingly viable, due to declines in solar PV system pricing in the past year.”

|

|

| NPD Solarbuzz: Distribution of More Than 2,400 Projects in the US PV Pipeline (50 kW or Larger) |

Not surprisingly, mega-scale PV projects above 100MW have recently dominated the utility-scale market in the US. According to the market research firm the 10 largest PV projects currently account for over 5GW of expected new capacity coming online over the next three years, dominated by a select few leading PVEPs (photovoltaic energy providers), such as First Solar and SunPower.

However, the trend away from mega-scale projects to those under 30MW was also increasing. NPD Solarbuzz noted that over the last 12-months the number of smaller projects had increased by 33% to more than 2,100 projects.

Companies such as SunEdison have been focusing for some time on smaller projects below 50MW as they have shorter planning phases, are easier to finance and can often be constructed within three months, potentially reducing highs and lows of quarterly revenue streams, a bane of publicly listed project developers.

The market research firm also noted that the transition to smaller projects is motivated by deadlines to qualify for the full US Investment Tax Credit (ITC) of 30%, which will be reduced significantly in 2017.

“With just three years remaining until the full tax credit incentive rate declines, solar PV project developers in the United States are now planning to complete projects, or have a significant portion under construction, prior to the 2017 deadline,” according to Christine Beadle, analyst at NPD Solarbuzz. “This deadline is causing a shift in focus to smaller projects that can be completed on shorter timescales.”

Despite the increased urgency in completing projects, data from NPD Solarbuzz indicated that only 8.5% of the 43GW US PV project pipeline was currently under construction, while 4.4% had been classified as delayed.

Importantly, the data indicated that 63.1% of the pipeline had reached the ‘planned’ stage, while ‘pre-planning’ was attributed to 23.9% of the pipeline.

Overall, US PV installations have been doubling each year for several years, yet for a large percentage of projects to be completed before the US ITC changes, US installations would need to significantly increase in the next few years.

Importantly, a large percentage of projects could come under threat of being cancelled outright if they look likely to miss deadlines. An unspecified number could also be delayed while new financing structures are obtained that restore IRR levels, post-ITC regression.

Email this page to a friend