|

|

|

|

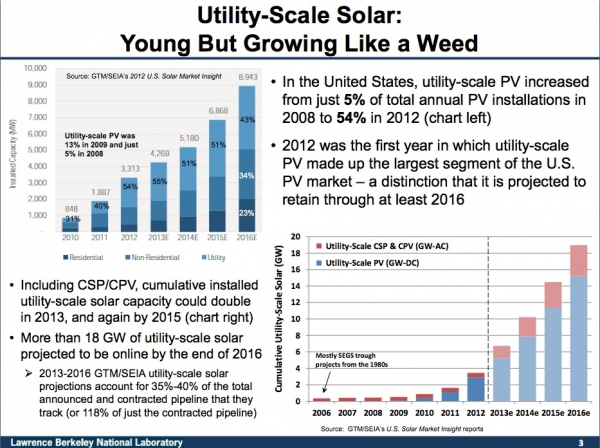

| 2012 was the first year in which utility-scale PV made up the largest segment of the US PV market – a distinction that it is projected to retain through at least 2016 |

Residential solar may steal the headlines and commercial solar show great promise, but utility-scale solar really is the 800lb gorilla in the room. In the US, utility-scale PV increased from just 5% of total annual PV installations in 2008 to 54% in 2012. In fact, last year was the first in which utility-scale PV made up the largest segment of the US PV market – a position it is projected to retain through at least 2016 when the Investment Tax Credit drops from 30% to 10%.

More than 3GW of utility-scale solar was online by the end of 2012, a number that is set to double this year, next year and out again to 2016, the date in everyone's diary in the solar industry. Until then GTM Research and the Solar Energy Industries Association project that more than 18 GW of utility-scale solar to be online by the end of 2016.

Mark Bolinger, a research scientist in the electricity markets and policy group at Lawrence Berkeley National Laboratory, said: "Since 2009 and 2010 the market has been growing rapidly. Even though it is a young market, it has been growing like a weed with relatively few signs of letting up at least until 2016."

|

|

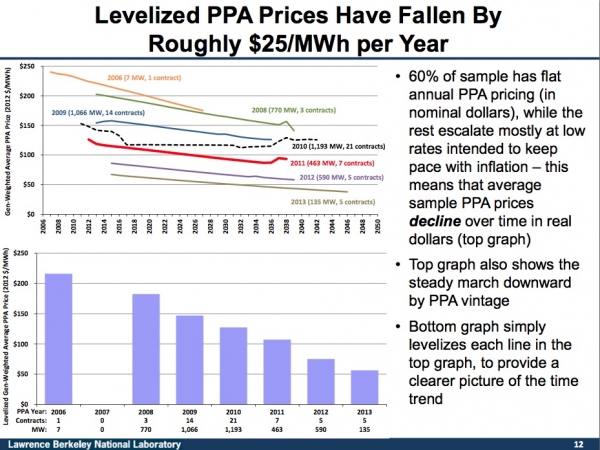

| Levelised PPA prices have fallen by more than two-thirds in the past five years, roughly US$25/MWh per year. |

Bolinger this year launched a new annual report series to track the operational data now emerging from utility-scale solar. Some of the results are fascinating and despite its dry title, ‘Utility-Scale Solar 2012: An Empirical Analysis of Project Cost, Performance, and Pricing Trends in the United States’, offers a new and important lens to envision the future of utility solar.

Installed costs are down. No surprise there. Cost declines have been happening in every sector thanks to the dramatic drop in PV panel prices. Installed project prices have fallen by nearly one-third since the 2007-2009 period, the report found, from around US$5.6/W to US$3.9/W on average for projects completed in 2012.

These declines have eroded the value of thin film as a utility-scale technology since those prices have held steady. Although Bolinger noted that PNM, New Mexico's largest utility, recently filed for regulatory approval of 23 MW of thin-film PV projects to be built in 2014 at a contracted price of just US$2.03/W, compared to US$2.29/W for 20 MW of PV currently under construction in 2013 and US$4.15/W for 22.5 MW built in 2011.

But in the age of the mega-project, Bolinger's data drawn from projects larger than 2MW offered some levelling advice for those who believe bigger should mean better (and cheaper).

"We find only limited economies of scale once you move beyond 5-10MW," he said. "One reason for this the basic unit is a 1.5MW power block, such as SunPower’s Oasis – a complete solar project 'in a box'. These power blocks have already most likely wrung out the economies available to PV. As you move beyond installing just a few of these, your incremental per unit costs are unlikely to fall all that much further, particularly given that as project size increases, other costs such as land costs, permitting costs, and even perhaps transmission costs, also tend to creep up therefore offsetting any scaling economies that might otherwise exist.

"Developers are realising that as you build these mammoth projects you run into all kinds of development problems."

Even though Sun Edison's utility-scale project team could be found at Solar Power International last month scratching their heads, wondering what is going to replenish their pipeline of large-scale projects. One answer could be a question of size since the trend might be away from the mega-project.

Data for PV operating and maintenance (O&M) costs was limited. So Bolinger drew out the numbers from bond offering prospectuses for three utility-scale solar projects: the 550MW Topaz project; the 579MW Solar Star plant (formerly the Antelope Valley Solar Projects); the 250MW Genesis project, a parabolic trough CSP project without storage.

From this scant data, Bolinger estimated O&M costs now appear to be in the region of US$20-40/kW AC per year, or US$10-$20/MWh – "largely in line with pro forma operating cost projections".

Solar appears to be particularly competitive when considering its time-of-delivery pricing advantage over wind (roughly US$25/MWh in California at current levels of penetration), according to the report.

However, that may be a short lived gain.

"Solar is beginning to give wind a run for its money in 2012 but particularly in 2013," said Bolinger. "It's a somewhat fleeting advantage that solar has. As PV penetration increases over time, the net peak load of solar generation will shift later and later into the afternoon and evening hours when the sun is not as strong. As that happens, PV's midday peaking profile will no doubt not be valued as heavily as it currently is. That's when storage or solar thermal with storage could start to make a lot more sense in the market."

Power purchase agreements have also shown dramatic declines, falling by US$25/MWh per year on average. Some of the most-recent PPAs in the western US have seen extremely aggressive PPA prices at US$50-60/MWh (in 2012 dollars), competitive with wind power projects in that region.

The four phases of the 458MW Copper Mountain project illustrate this decline perfectly. They are all located in the same area, owned and operated by the same independent power producer (Sempra Generation US Gas & Power), and the first three phases use First Solar’s CdTe thin-film modules in a fixed-tilt configuration with long-term PPAs with the same counterparty, Pacific Gas & Electricity. Sempra announced in August this year that the fourth phase would switch technology to cSi modules made by Trina Solar.

However, the PPA declines tell an intriguing story. The PPA for the initial 10MW phase (El Dorado) was signed in December 2008 at roughly US$150/MWh (in 2012 dollars). Six months later, in June 2009, an additional 48MW PPA was signed (Copper Mountain 1). Two years later, in July 2011), a further 150MW (Copper Mountain 2) was signed at US$103/MWh for a 25-year PPA. In August 2012, 250MW (Copper Mountain 3) was signed at US$82/MWh.

"There is some disconnect between installed costs and PPA pricing," said Bolinger. "There's clearly some forward pricing being factored into these projects and they are not expected to come online until 2016 in some cases. Even though we're showing prices US$3-4 per watt range these projects have been bid into PPA RFPs assuming they're going to get down to US$2.50 to US$2 per watt, which we are seeing happen in some cases.

"If you drop the installed price down to US$2.50 to US$2 using a 30% capacity factor of US$30 per kW per year, with O&M costs and total op-ex costs you can make these PPA levels work. The return is not super high, it's probably not as high as the developers would like, but it is positive, maybe 6-7% or 8%."

But some PPA prices are hitting a mark at around US$60MWh, which begs the question of whether the project will even get built, said Rob Sternthal from Reznick Capital Markets Securities.

"Everything above US$80 has been sold or is moving. Anything in the US$60s right now people don't think it's buildable based on the returns.

"The other huge misconception here is when you look at the returns you assume the buyer is MidAmerican or is somebody that has tax appetite and can use it. Once you take that out of the equation, your 8% return goes down to 6, 5 or 4% depending on the structure of your tax equity. If you don't have the tax equity you're going to use a less efficient structure which is going to cost you probably a couple of hundred basis points at a minimum on equity return.

"When you start looking at projects at 6% there's no debt below that so there's no way to make debt accretive to a project so now you're also all equity, which is also terrifying. If you can get above 7% the debt can bring you to low teens; that's important for most investors."

When they were signed, PPAs for CPV and CSP were largely competitive, but developers are extremely cagey about letting their prices be known after the collapse in PV prices.

"Unfortunately, we don't have any more recent visibility into that comparison, which could be telling in itself," said Bolinger.

However, it's clear that the utility market has two stories in parallel: the build-out is happening fast now and the pipeline turning from a fire hose to a trickle, especially after 2016.

After the procurement push from the investor owned utilities driven by the Renewable Portfolio Standard, the utility segment may have to recalibrate itself away from the mega-project. In fact, it's a sweet spot in megawatt size and low cost that suits municipal utilities better than the IOU behemoths.

Edward W Zaelke, from lawyers Akin Gump Strauss Hauer & Feld, said: "When we talk about the power prices going down into the US$60 range and comments about whether or not that's financeable, that's all relevant to where we see this industry moving on the utility-scale side.

"There was a time three or four years ago when folks looked at the demographics of this country and people were moving to the south west and natural gas prices [were high] and we thought that the south west in particular would be covered with large utility scale projects. Some of that began to occur; we have projects north of 500MW going into the ground.

“That was the trend for contracts signed three or four years ago. But while we see a few of those mega-contracts still out there they tend to be tied to employment in a particular area. But the 20MW size seems to be what we're moving to – but size doesn't seem to make a difference if price is about the same."

Updated: 2003/07/28