HCPV cell efficiencies to exceed 45% by 2017, says IHS

Mar 10, 2014 - Andy Colthorpe - pv-tech.org

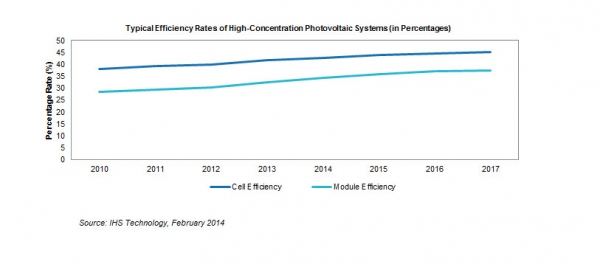

High-concentration PV (HCPV) systems will reach cell efficiencies exceeding 45% by 2017, while the world’s biggest regional markets for HCPV will be in the United States and central America, according to a new report by analysis firm IHS.

|

| The CPV market is set to liven up in the coming years, according to IHS. Image: Soitec. |

IHS also predicts that the competitive landscape for CPV will “liven up” over the next five years, with the market still in the early phases of growth. In a release to accompany the report, 'CPV on the edge of breakthrough', IHS says “HCPV is gradually becoming attractive in several regions of the world".

In addition to the US and Central America, the company has predicted that the HCPV market in South America will show “enormous growth”, while the Middle East and Africa will show the “greatest increase” of all regional markets. Excluding South Africa, the Middle East and Africa region will see installations boom from 1.8MW in 2012 to 155MW by 2017, with demand mainly expected to be driven by Morocco and Saudi Arabia.

|

| Cell efficiencies for HCPV systems are currently at around 40% to 42%. I.H.S expects this figure to exceed 45% by 2017. According to I.H.S, this will lead the efficiencies of commercial systems to increase by around 5% to 40%. At 40% to 42% cell efficiency, current commercial system efficiencies are at around 35%. Image: IHS. |

South America meanwhile, will begin installing HCPV generation capacity by the end of this year, before installations surge to 560MW by the end of 2017.

China is expected to become increasingly important as a supplier of modules, but IHS also predicts the south west region of the Asian country could host “prime” HCPV locations.

Cell efficiencies for HCPV systems are currently at around 40% to 42%. IHS expects this figure to exceed 45% by 2017. According to IHS this will lead the efficiencies of commercial systems to increase by around 5% to 40%. At 40% to 42% cell efficiency, current commercial system efficiencies are at around 35%.

Under laboratory conditions, CPV cells have reached efficiencies of 44.7% - based on this, IHS has predicted the aforementioned further improvements in efficiency. IHS analyst Karl Melkonyan, who authored the report, said that manufacturing costs will rise with the production of higher efficiency cells and that for manufacturers and developers, the benefits of improved cell efficiency would have to be weighed up against these rising costs.

Nonetheless Melkonyan said that cell efficiency is the “most important requirement in CPV technology in order to generate competitive energy costs”.

The report acknowledged that 2011 and 2012 were tough years for HCPV companies in the wake of the price collapse for conventional PV modules. While the industry has regained stability and costs keep falling due to technological advances, IHS said, many competitors have fallen by the wayside and only those with the most cost-efficient technologies and large cash balances have survived.

Over 80% of the entire CPV market is represented by just five companies, including Suncore, Soitec and SunPower, with I.H.S tipping US company Semprius and French company Heliotrop as possible entrants to the top 10 this year. The two biggest manufacturers, Suncore and Soitec, are each expected to install around 50MW of CPV this year. Several newcomers and start-ups are expected to “liven up the competition” over the next five years, however, according to the report.

Other recent reports from IHS have seen predictions of growth in markets for grid-connected energy storage and in capital spending for PV manufacturing, as well as tough times forecast for mid-sized solar engineering, procurement and construction (EPC) companies.

Karl Melkonyan also authored an IHS report on the wider CPV market, published in December. In it the analyst focused on falling costs of CPV installation costs and predicted that global CPV installations will “boom” by 750% between 2013 and 2020.

|